Most Swiss Asset Managers Missed the Alternatives Boat

- Alistair Lamb

- Nov 3, 2023

- 2 min read

Updated: May 17, 2024

Asset managers that have pushed into alternative asset classes have been rewarded with high revenue growth due to high AuM margins and higher AuM growth.

In our last post "A Battle Between AuM Growth and AuM Margin Decline" we saw that asset managers across regions are experiencing declining AuM margins. Swiss managers were however able to keep their margin higher than their European and North American peers. Revenues have grown in all regions because AuM grew faster than AuM margin declined.

But this is not true across the board.

In this post we see the trend away from fixed income into alternatives has left traditional Swiss managers with flat revenues, while alternatives revenue has grown rapidly.

With AuM margin of alternative managers significantly higher than traditional managers…

AuM margin (the management fees received from AuM) is declining globally. It fell from 34 bps to 27 bps for traditional managers.

AuM margin of alternative managers is also declining from 183 bps to 83 bps, but is still far higher than traditional managers.

…revenue growth of Swiss traditional managers lags that of alternative managers.

Revenue growth for Swiss traditional managers is flat, and much lower than their alternative peers.

Swiss alternative management is dominated by a single player. This overstates the health of Swiss AM over metrics such as revenue.

On the whole, Swiss managers have been too slow to develop capabilities in alternatives.

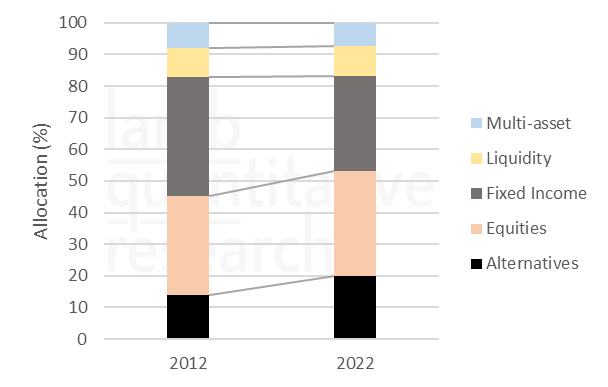

Demand for alternatives has shifted global assert allocation away from fixed income.

Global allocation to alternatives grew from 14% to 20% at the expense of fixed income (FI) as FI investors looked to avoid negative real returns.

Higher real rates may cause a part reversal of the trend away from FI.

Higher fees are the incentive for managers to expand offerings in alternatives.

But does higher revenue mean higher profits?

Do high fees translate into better returns for clients?

…to be continued….

Download the full report "Swiss Asset Management on the Global Stage".

Comments